MEMPHIS, Tenn. — Financial experts have warned the rising home prices in the Memphis area could further impact the wealth divide between black and white residents in the area.

For many Americans, property is their largest asset.

But out-of-town investors have bought thousands of homes in Shelby County in the past two years. It has made it difficult for local residents to purchase homes.

Many of the homes purchased by investor groups are under $200,000. That price point has squeezed out many local buyers. Financial experts said it not only impacts where people may live, but potentially their bottom line.

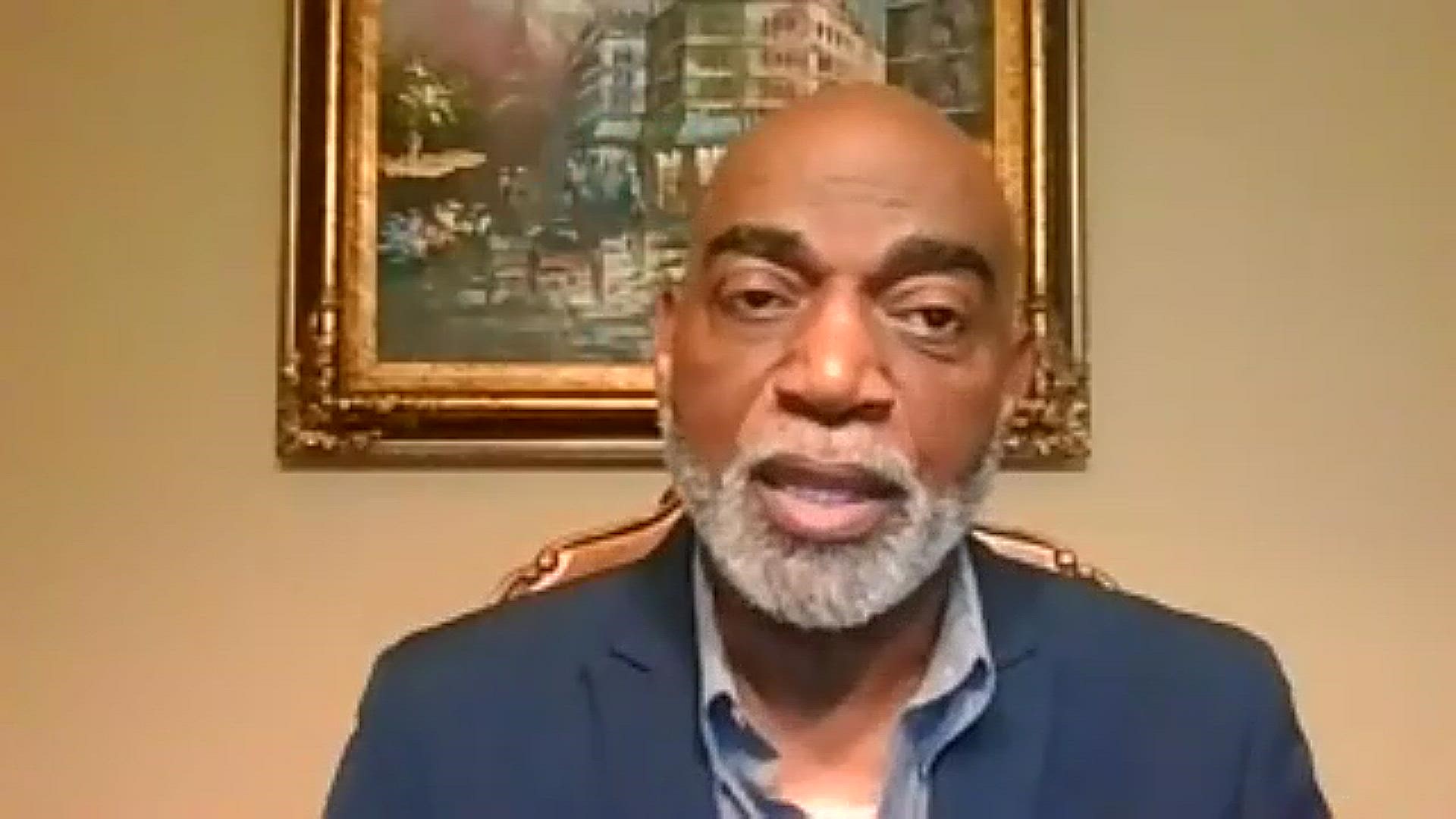

"Those who are renting have nothing to pass on," said Financial Advisor Charles Sims with Sims Financial Group.

Sims said for most Americans, and especially for American Americans, owning their home has been key to creating generational wealth. Real estate typically appreciates in value, and that can be passed on.

"One way of moving generational wealth is to buy real estate," said Sims. "The previous generation has used the real estate to live in. And then it is passed on to the next generation. A lot of other cultures have done that. People of color, in the last decade or two, have begun to buy more real estate," said Sims.

A recent Shelby County analysis found 7,000 single family homes were bought by investors in the past two years and converted to rentals.

With so many investors bidding on homes, it can be difficult for a local to lock one in and become a homeowner.

"When you have outside investors come into Memphis and buying the real estate en masse, that causes the local people who want to use these same homes to live in to not to be able to compete," said Sims. "The value of these houses go up and the local people cannot buy them."

A Lending Tree study found Black Americans in Memphis own the smallest percentage of homes relative to their overall population. Sims is concerned unless something is done to stop the influx of out-of-town and out-of-country investors, prices will continue to rise, making it even harder for locals to own homes - and the racial wealth gap will continue.

"Memphis needs to come up with a speculation law to keep outside investors who do not live in Memphis and Shelby Community from buying these properties en masse," said Sims. "It’s going to have to start at the governmental level, because the individuals who have no power can do nothing about it."