KNOXVILLE, Tenn. — Two proposals by Governor Bill Lee during his State of the State address in February are in limbo, as the Tennessee Senate and House stay divided on how to move forward.

The divisions in the legislation proposed for the school voucher proposal and the franchise tax amount to hundreds of millions of dollars, according to the fiscal notes on both bills.

First, the Senate and the House have different versions of Governor Bill Lee's universal school voucher proposal. Both proposals would give families about $7,000 for "Education Savings Accounts" -- public money to pay for private school costs.

The House version of the bill includes funding for other priorities in public schools, including covering more of the health insurance for school employees.

"That bill was not going to ever get any support from the House members, especially those rural members and some of the suburban members," said Rep. Sam McKenzie (D-Knoxville). "So what did they do? They threw pork at it."

The Senate version doesn't have funding for other public school priorities. The sides are also divided on testing.

"The doctor's prognosis is that the voucher bill is dying," said Sen. Richard Briggs (R-Knoxville), a former physician.

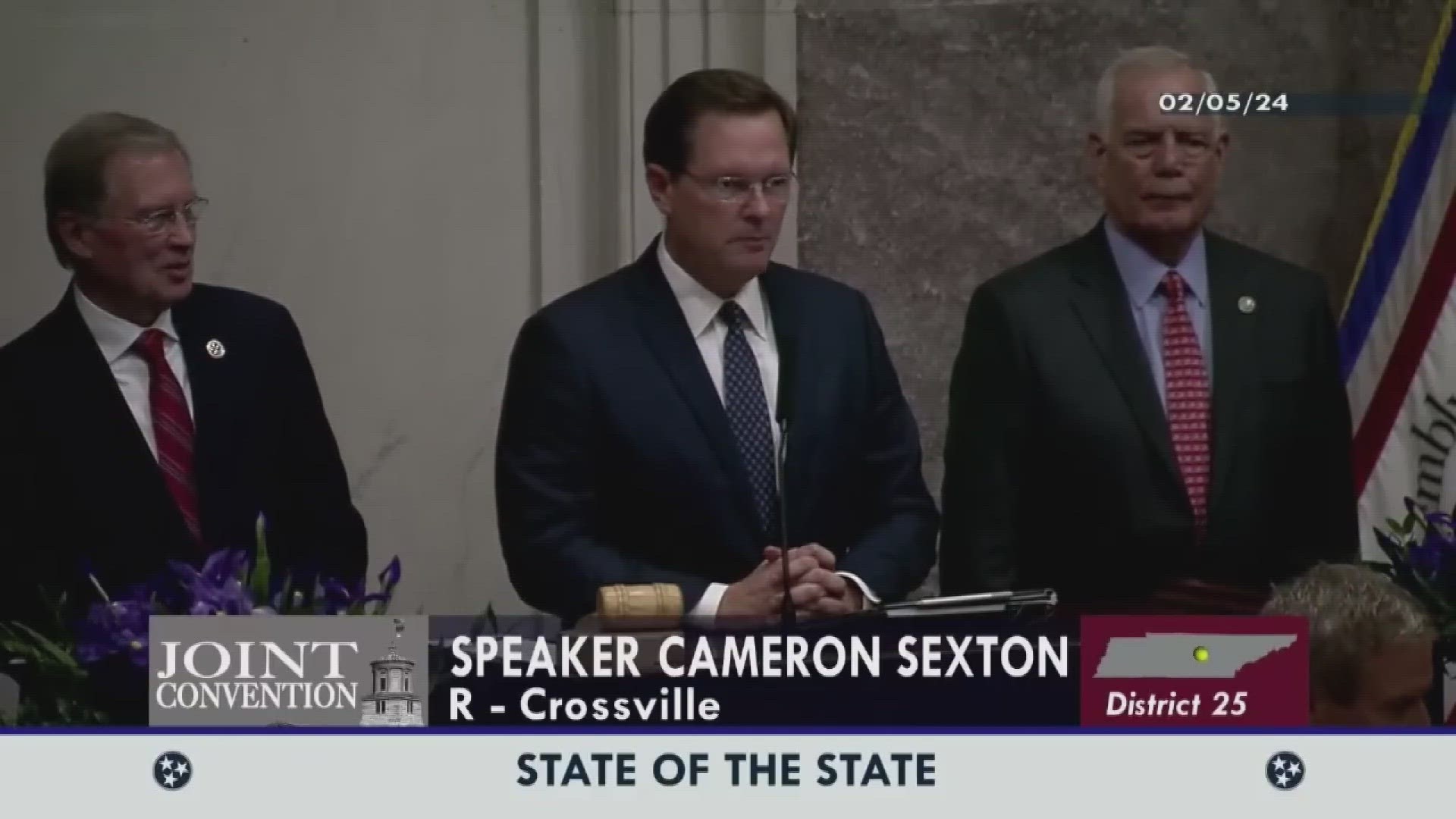

House Speaker Cameron Sexton (R - Crossville) said in an email to 10News that the bill will not advance in the House and Senate unless the sides reach an agreement on how to proceed.

"Our conversations with the senate and Governor have been productive and ongoing," Speaker Sexton said in that email.

Lt. Gov. Randy McNally (R - Oak Ridge) said if the House and Senate haven't come to a compromise by next week, the Senate will likely adjourn without passing a bill on the vouchers.

"It's the governor's bill," said Rep. Jeremy Faison (R - Cosby), the Republican caucus chair in the House. "He will have to say when it's over, if it's over."

Two key issues divide the House and the Senate for the franchise tax bill. Lawmakers said they have to provide a tax rebate to some of the largest businesses in Tennessee because the state improperly calculated the franchise tax.

In the House, leaders agreed to provide the rebate for a year, with the caveat that information on the companies who received it would be public. The Senate would provide the rebate for three years, without the transparency aspect.

"It is our feeling that we ought to do what we've always done in the past," said McNally. "That is to protect the taxpayers' information."

Sexton said the House is not willing to give up the transparency portion of its version of the bill.

"We won't go as far as they are, and I don't think they'll go as far as we are," Faison said. "I don't know that we're going to give much."

The franchise tax bill passed both the Tennessee House and the Senate. It will likely go to a conference committee, with appointees from the House and the Senate having to work out the differences before it can become law.

Last year, a special session on public safety highlighted the deep divide between the House and the Senate. House members wanted to pass a slew of bills, while the Senate only wanted to pass three as well as a routine bill for funding.

Briggs, Faison and McNally insisted the House and the Senate have a good working relationship.

"I cannot speak for the other chamber, but members of the House chamber are focused solely on legislating for our constituents, not settling grudges," Sexton said in that email.